do nonprofits pay taxes on rental income

Most individuals use the cash basis method This method requires you to report income as. There are certain circumstances however they may need to make payments.

Guide To Tax Deductions For Nonprofit Organizations Freshbooks

Which Taxes Might a Nonprofit Pay.

. For the most part nonprofits are exempt from most individual and corporate taxes. Any gain allocated to the unrelated business purpose is taxable. List your total income expenses and depreciation for each rental property on the appropriate line of Schedule E.

Generally speaking rents from real property are excluded from UBTI. Taxes on investments depend on the investment type. In New Hampshire RSA 7223 governs the taxation of real property.

But determining what are an organizations exempt purposes is not always as clear as one might think and distinguishing between related and unrelated activities can be tricky. Answer 1 of 22. Seems simple but it never is.

For rental property for each year this is about 364 of the amount that you paid for the rental property. I hope this helps. 1-2006 This information guide provides an overview of how Nebraska sales and use income and withholding tax laws apply to nonprofit organizations.

12-2009 Supersedes 7-215-1992 Rev. However not all rental income is subject to unrelated business income. Below well detail two scenarios in which nonprofits pay tax.

Taxes on Rental Income. Understandably most charities in the state are constantly looking to do more with less. This guide is for you if you represent an organization that is.

While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes. The IRS defines unrelated business income UBI as income from a trade or business regularly carried on by a nonprofit organization that is not substantially related to the performance by the organization of its exempt function. If you do not rent your property to make a profit you can deduct your rental expenses only up to the amount of your rental income.

It is not designed to answer all. Churches and religious organizations are almost always nonprofits organized under Section 501 c 3 of the Internal Revenue Code. For example if your nonprofit earns any income from activities unrelated to its purpose it will owe income taxes on that amount.

Report your not-for-profit rental income on Form 1040 or 1040NR. In any of the case if your total income in a year exceeds the exemption limit which is. So the way that you pay no income taxes on rental property is to have no taxable income by having expenses equal to the rental income.

You cannot deduct a loss or carry forward to the next year any rental expenses that are more than your rental income for the year. You can earn in 3 ways while working for non profit organizations. One place prudent charitable organizations look to increase their income is from rent generated by the facilities they own and maintain.

May 03 2021 3 min read. A non-profit organization NPO as described in paragraph 149 1 l of the Income Tax Act. One source of UBI is rental income.

However there are two exceptions where this type of income is taxable. Dividends interest rents annuities and other investment income generally are excluded when calculating UBIT. This means the rental income investment income and many other forms of income that would be tax exempt for other organizations are not tax exempt for 501c7 9 and 17 organizations unless the income is derived from activities substantially related to the exempt purpose.

The rental income you declare on your income taxes will depend on your method of accounting. If the nonprofit uses the property for an unrelated business it pays tax as described in Form 598. Tax-exempt organizations also known as 501 c 3 organizations can have Unrelated Business Taxable Income UBTI when the organization has revenue streams outside of its direct charitable purpose.

If you rent real estate such as buildings rooms or apartments you normally report your rental income and expenses on Form 1040 or 1040-SR Schedule E Part I. 1st by the way of salary 2nd by way of contractual payments last by way of professional receipt. There are clear rules as well as several exceptions to.

Nonprofit Organizations for Sales and Use Income and Withholding Taxes Revised December 2009 INFORMATION 7-215-1992 Rev. Because churches operate to serve peoples spiritual needs foster a sense of community and undertake charity they are tax-exempt and allowed to accept tax-free donations. While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes.

If youve formed an unincorporated association for the purpose of doing public good incorporating as a nonprofit corporation or applying for IRS tax. Unincorporated Nonprofit Association vs. For the most part nonprofits and churches are exempt from the majority of taxes that for-profit businesses.

But determining what are an. A nonprofit that uses the property for a mix of related and unrelated purposes has to allocate gain from the sale between the two. An agricultural organization a board of trade or a chamber of commerce as described in paragraph 149 1 e of the Act.

You use Form 990-T for your tax return. This could however have unintended negative consequences. Any nonprofit that hires employees will also.

Do nonprofits pay taxes. Published on September 4 2014. And while churches are not allowed to turn a profit.

Rental Income and UBTI A Look at the IRS Guidance to Its Auditors.

Form 990 Guide To Filing Instructions For Nonprofits Araize

Tax Information Nonprofits Renting Extra Space Church Facility Solutions

Documents Needed To Apply For A Texas Id Or Texas Drivers License How To Apply Houston Community Texas

Unrelated Business Income Tax Ubit For 501c3 Nonprofits

A Guide To Tax Filing Requirements For Nonprofit Organizations

Explore Our Image Of In Kind Donation Receipt Template Receipt Template Donation Letter Template Teacher Resume Template

Reporting Nonprofit Operating Expenses Nolo

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping In 2022 Chart Of Accounts Accounting Downloadable Resume Template

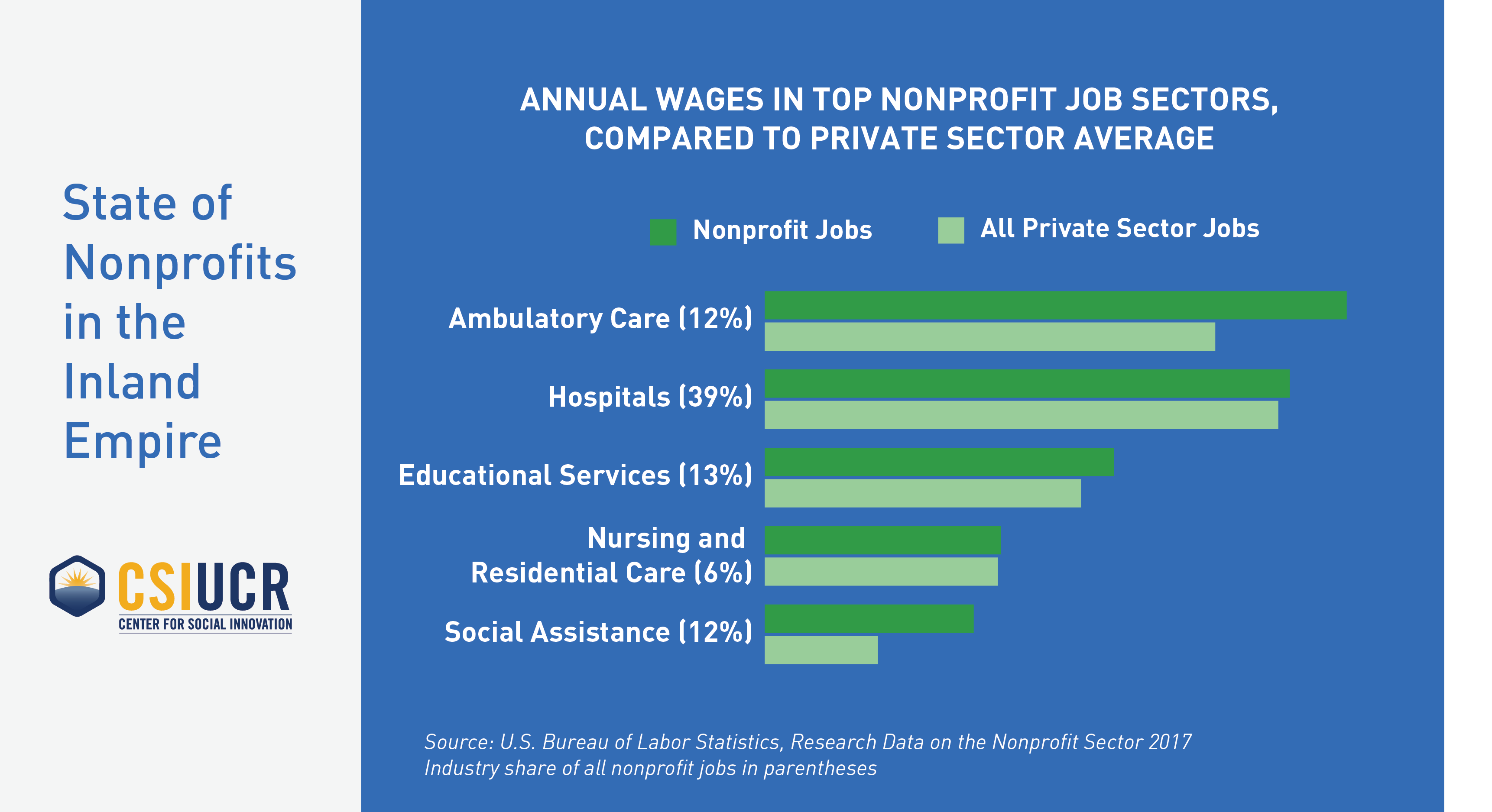

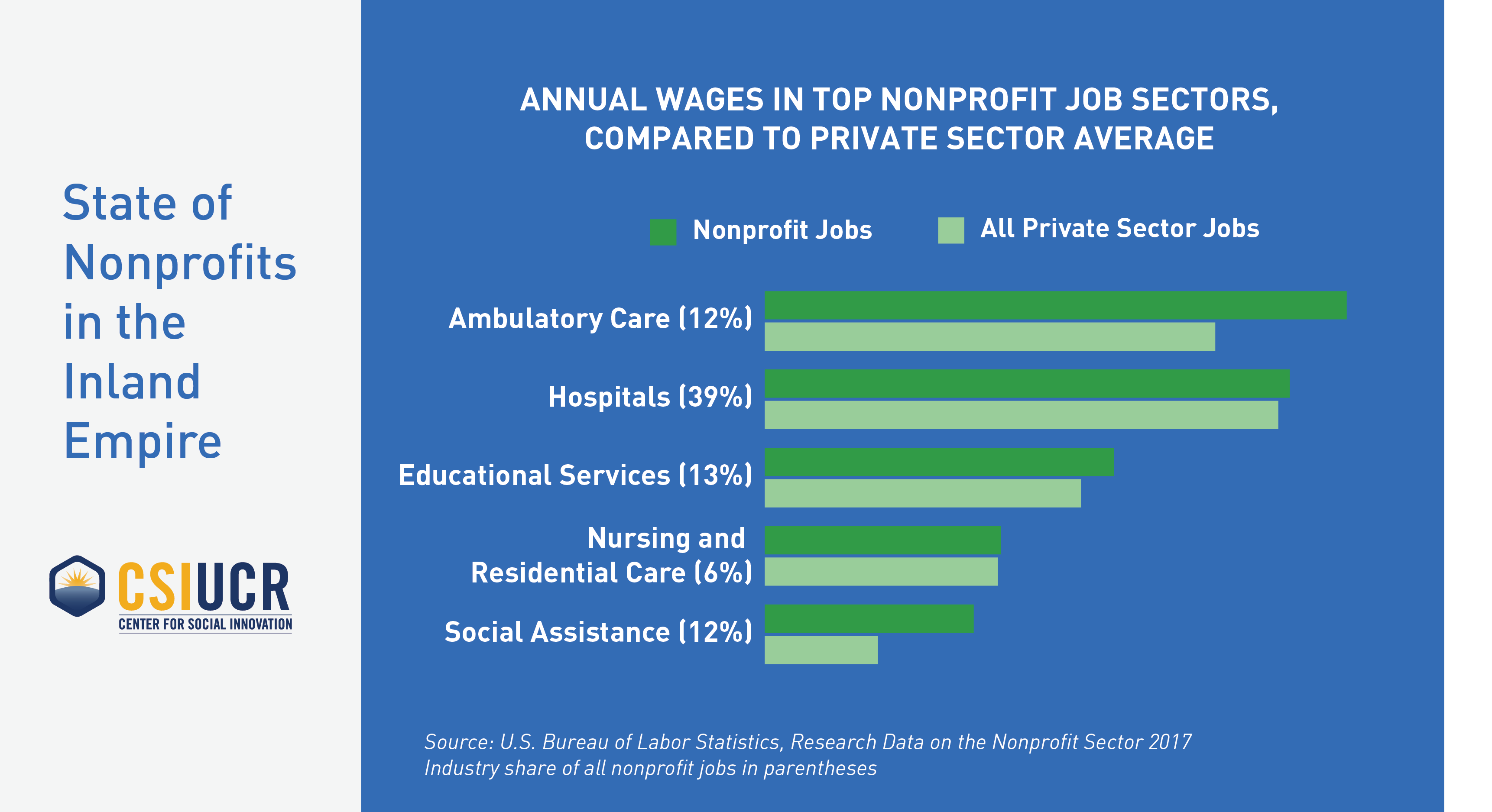

State Of Nonprofits In The Inland Empire Center For Social Innovation

Accounting For Nonprofit Organizations Financial Statements Beyond

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics

Florida Property Appraisers Consider Troubling Position On Property Tax Exemption For Nonprofits Based On Recent Court Decision Batts Morrison Wales Lee P A A Non Profit Cpa Batts Morrison Wales

Ubit Issues For Shared Spaces Nonprofit Law Blog

Misuse Of Funds Nonprofit Help Fraudulent Misappropriation Charity Fundraising Nonprofit Fundraising Non Profit

Nonprofit Statement Of Activities Report Net Asset Changes

List Growth Campaign Pricing For Nonprofits Care2 Campaign Non Profit Graphing