san francisco sales tax rate breakdown

The minimum combined 2022 sales tax rate for San Francisco County California is 863. The total sales tax rate in any given location can be broken down into state county city and special district rates.

California Sales Tax Rates By City County 2022

This is the total of state and county sales tax rates.

. 2020 rates included for use while preparing your income tax. Ad Find Out Sales Tax Rates For Free. The 2018 United States Supreme Court decision in South Dakota v.

Stockton California with a 875 sales tax but the goods will be used stored or consumed in San Francisco which has a sales tax rate of 950 then the department needs to accrue the. California has a 6 sales tax and. San francisco sales tax rate breakdown.

The current total local sales tax rate in san francisco ca is 8625. The California state sales tax rate is currently 6. 4 rows Sales Tax Breakdown.

The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy. For questions about filing extensions tax relief. 750 Is this data incorrect The South San Francisco California sales tax is 750 the same as the California state sales tax.

This tax does not all go to the state though. In San Francisco the tax rate will rise from 85 to 8625. San Francisco has parts of it located within San Mateo County.

Within San Francisco there are around 39 zip codes with the most populous zip code being 94112. How much is sales tax in San Francisco. San Francisco Tourism Improvement District.

Method to calculate San Francisco sales tax in 2021. Please contact the local office nearest you. California Sales Tax.

San Francisco imposes a 14. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025. The minimum combined sales tax rate for San Francisco California is 85.

The latest sales tax rate for San Francisco County CA. The December 2020 total local sales tax rate was 8500. 4 rows Sales Tax Breakdown.

The latest sales tax rate for San Francisco CA. This is the total of state county and city sales tax rates. 4 rows Sales Tax Breakdown.

5110 cents per gallon of regular gasoline 3890 cents per gallon of diesel. Fast Easy Tax Solutions. This rate includes any state county city and local sales taxes.

This scorecard presents timely. California has a 6 sales tax and San Francisco County collects an. The minimum sales tax in California is 725.

The transfer tax rate is variable depending on the purchase price OR the fair market value as shown in the chart below. In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. The true state sales tax in California is 6.

Although this is sometimes conflated as a personal income tax rate the city. Sales tax region name. The minimum combined 2022 sales tax rate for Shasta County California is.

Those district tax rates range from 010 to. The statewide tax rate is 725. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses.

Per SF Assessors website 32017 In San Francisco transfer taxes. The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

As we all know there are different sales tax rates from state to city to your area and everything combined is the required. Presidio San Francisco 8625. Limited to 15 per year on the minimum base tax 30 per year on.

As far as sales tax goes. This rate includes any state county city and local sales taxes. This is the total of state and county sales tax rates.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The Sales and Use tax is rising across California including in San Francisco County. While many other states allow counties and other.

Most of these tax changes. The San Francisco County sales tax rate is 025. 2020 rates included for use while preparing your income tax deduction.

Frequently Asked Questions City Of Redwood City

Us Sales Tax On Orders Brightpearl Help Center

Understanding California S Sales Tax

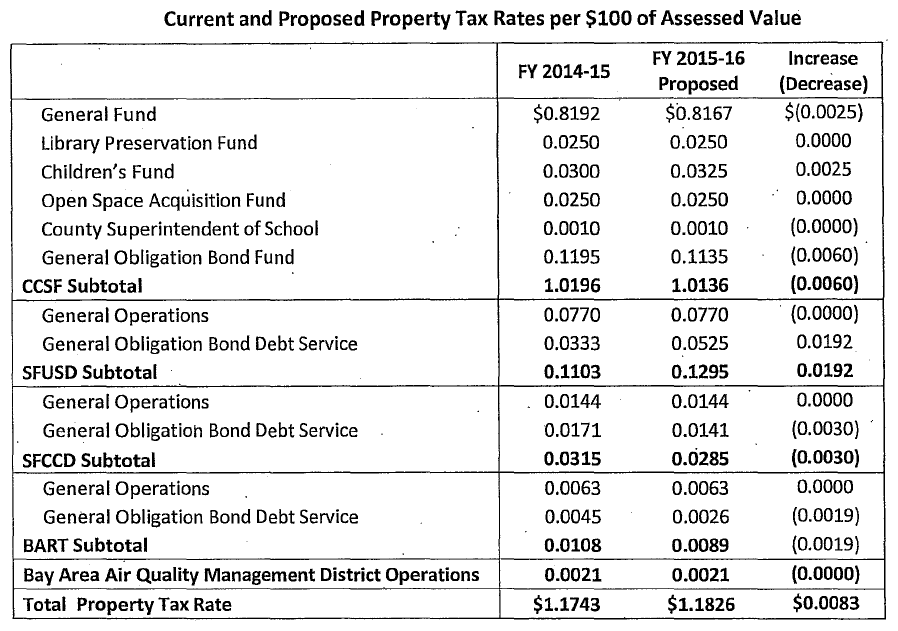

San Francisco Property Tax Rate To Rise Where The Dollars Will Go

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax Collections City Performance Scorecards

Understanding California S Sales Tax

Understanding California S Sales Tax

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

Food And Sales Tax 2020 In California Heather

How Do State And Local Sales Taxes Work Tax Policy Center

California City County Sales Use Tax Rates

California Sales Use Tax Guide Avalara

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Understanding California S Sales Tax